Single and Available!

To set the record straight (and stay out of trouble with my spouse 😉), I am happily married for over twenty years and this article has nothing to do with dating.

Single and Available! refers to the state and structure of agreements and contract instruments used to by Federal agencies in a given year, when they make awards to one company versus multiple companies. Why this should matter to most companies pursuing contracts and subcontracts is a simple concept. Time and money.

First, I’m going to hit you with numbers, then I’ll describe why they are important, and more.

- Last year, fiscal year 2022, federal agencies reported $694B in obligations to FPDS.gov

- $542.5B or 78% of the total obligations were issued using contracts and contract vehicles awarded to a single company

- $308B or 44% of total obligations were awarded using Definitive Contracts (other than Indefinite Delivery Vehicles or IDVs) and Purchase Orders

- Single and Multiple-Award Indefinite Delivery Contracts or IDCs (includes Indefinite Quantity(IDIQ), Definite Quantity (IDDQ) and Requirements contracts(IDR)) and Definitive Contracts accounted for $496.6B or 72% percent of total obligations

A Long Time Ago in a Galaxy Far, Far Away…

Fiscal year 1992 was my fourth year in federal contracting. Those first years were formative as I was working for a small company directly supporting national security and national defense missions during Operation Desert Shield and Desert Storm. My perspective on federal contracting was shaped significantly by what I saw and learned during this time. That fiscal year, the Government obligated $157B according to FPDS. The majority of those dollars, 82% or $128B, were obligated to Definitive Contracts and Purchase Orders. Total obligations to multiple-award contracts were a whopping 8% of the total spend that fiscal year. I offer this as background to the context I lean on when discussing and reviewing information related to federal spending.

Despite the efforts of GSA and others to have a majority of (if not all) federal contracting dollars obligated according to Spend Under Management (S.U.M.), dollars to single-award contracts and single-award contract vehicles continue to maintain the high ground. Don’t know what S.U.M. is? It’s the criteria defined by OMB under the government-wide category management initiative rolled out in 2016. It’s also the acquisition strategy that brings us the phrase Best-in-Class or BIC.

It’s a Really, Really Big Squirrel

If you don’t get my reference to squirrels, I can use shiny objects instead (Thanks, Mark Amtower). Both squirrels and shiny objects are those distractions that take you off course. The cultural shift that introduced a new kind of squirrel happened when the O.G. GWAC, NASA SEWP, was born. That’s right, NASA SEWP is the first and most successful GWAC/BIC, and for multiple reasons. One of those reasons, according to the good folks at the NASA SEWP PMO, is the fact awards have been made to all SEWP contract holders. Plus, their Industry Provider approach creates a way for companies to do business on SEWP without being a contract holder. Pretty neat. All of this is a big deal considering the number of goose eggs associated with the FSS/MAS Schedules, and many other multiple-award contracts (MACs). This also matters because of the number of companies, large and small, who chase government-wide, multi-agency, and agency-specific MACs, and end up with little to nothing to show for their efforts, even if they are selected as a successful offeror. Now take that number and multiply by a factor of ten or twenty. This now includes all of the teaming partners and subcontractors who make the investment to be on a winning team, and again, end up with little if anything to show for their efforts, even when a win occurs.

How much of the time and money invested in these pursuits could be directed at other relevant opportunities? In a recent blog I offered companies should ‘Focus on work, not contracts‘ to help them see more viable opportunities where the opportunities begin, which is not in the Contracting Office.

Did He Just Say That?

Am I referring to the various types of MACs as distractions? Yep. Let me qualify this. Looking down from the highest observation point in Federal Contracting, what you can see based on dollars, contract actions, and more, is the footprint of the Award and IDV Types you will find in the FPDS Data Dictionary, and in the FAR. What follows is a look at the Award and IDV Types referenced in FPDS based on the following:

- the obligations associated with the specific Award/IDV Type during FY2022

- Number of Contracting Departments utilizing the award or IDV

- Number of Funding Departments utilizing the Award or IDV

As an added bonus, I’ve added language to each line of obligations for Award/IDV Types that are Single-Award Only, or can be issued as either Single or Multiple-Award, to highlight the obligations not made to MACs.

NOTE: The total number of reporting Contracting Departments for FY22 is 70, and the total number of reporting Funding Departments is 93.

- Contracting Department represents the federal entity responsible for issuing and administering agreements, contracts and orders

- Funding Department is the federal entity providing the funding that will be obligated by the Contracting organization

-

Basic Ordering Agreement/BOA

- $15B ($13B Single-Award)

- Number of Contracting Departments – 14

- Number of Funding Departments – 19

-

Blanket Purchase Agreement/BPA

- $21.3B ($15B Single-Award)

- Number of Contracting Departments – 56

- Number of Funding Departments -73

-

Federal Supply Schedule/FSS (MAS)

- $20.9B (FPDS)/$41B (SSQ+)

- Number of Contracting Departments – 61

- Number of Funding Departments – 79

-

Government Wide Acquisition Contract/GWAC

- $24.4B

- Number of Contracting Departments – 62

- Number of Funding Departments – 79

-

Indefinite Delivery Contract/IDC

- $304B ($205B Single-Award)

- Number of Contracting Departments – 56

- Number of Funding Departments – 81

-

Definitive Contract/DCA

- $291B (All Single-Award)

- Number of Contracting Departments – 60

- Number of Funding Departments – 67

-

Purchase Order/PO

- $17.5B (All Single-Award)

- Number of Contracting Departments – 67

- Number of Funding Departments – 84

What you can take away from this is the fact not every federal agency uses certain Awards or IDVs. If you note the disparity in the number of Contracting vs Funding organizations, you will also note that not every agency uses a Contracting organization unique to their agency. Even those agencies with Contracting organizations sometimes opt to outsource the procurement.

Uppercut First, Then Right Hook

If you look at the fiscal distribution of dollars, you will find it doesn’t support the hype demonstrated by the talk from many agencies, nor the unbalanced level of attention Industry gives to MACs. Some additional insights about MACs includes:

- Of the $152B in MAC awards during FY2022, all but $400M was reported as competitive awards in FPDS

- Small Business Concerns captured $63.5B of total MAC obligations in FY2022

- 16 Contracting Departments obligated more than $1B each in MAC awards

- 35 Contracting Departments obligated less than $100M each in MAC awards

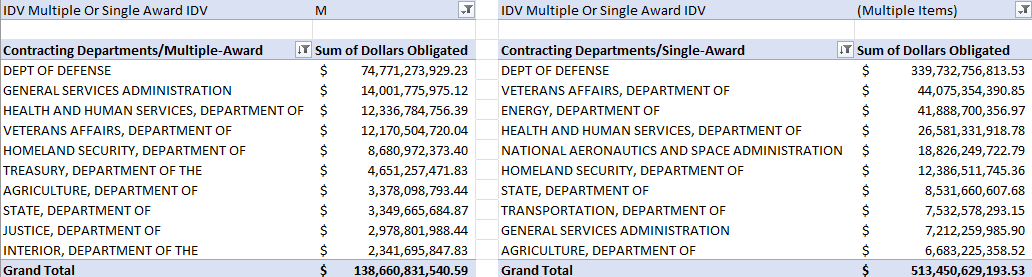

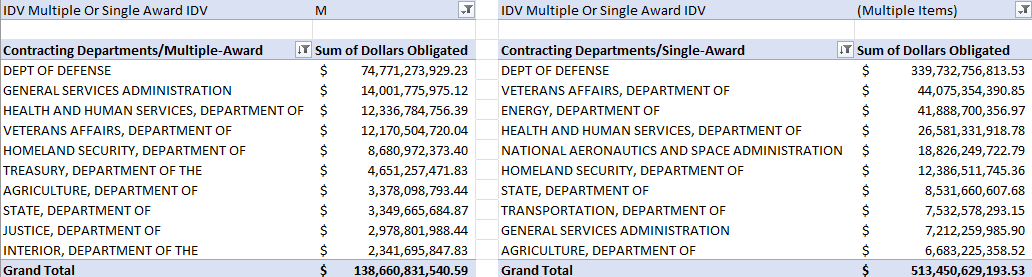

Below is a snapshot of obligations by the top ten Contracting Departments for FY2022. The left is based on MACs, and the right based on Single-Award contracts and contract vehicles.

Final Thoughts

This is a summary look at federal obligations to single-award and multiple-award instruments. The point is not to convince you to pursue one versus the other, but to inform you of what you may miss if an over-dependency on contract ceilings guides your vision, versus focusing on dollars associated with requirements, regardless of the Award or IDV Type to be used. Do your homework early and often to ensure a good return on your time and money.

Peace, Health, and Success,

Go-To-Guy Timberlake

For a PDF version of this blog click here.