Trust, But Verify Your Federal Sector Market Intelligence.

Ethical Stalking for Government Contractors® is a curriculum and a philosophy based on being able to find the information needed to make good decisions. It is also based on having the ability to understand the information being found, so that discerning useful data and information from irrelevant, is possible. When used in conjunction with established processes, such as the Business Development Life Cycle, the resulting outcomes include savings of time and money, and greater likelihood of achieving desired results.

Here’s an irrefutable truth. If you make business growth decisions, such as go/no-go and bid/no-bid using incomplete or incorrect information, you will not achieve the results you intended. The premise of this assertion and this entire article, is context. Intelligence, information you can use and trust as you make decisions, is the result of acquiring information-in-context. I’ve discussed this in several other articles, seminars, workshops and cohorts, and will continue to do so, because it’s important. Simply, if you are confronted with a situation such as disarming a bomb, and you don’t understand the fundamental properties of a bomb, then you might not make a good decision for you, or anyone around you. Is it the red wire or the green wire?

In federal contracting, this is a daily occurrence. Well-intended companies and their people, from all walks of life and business, dive into doing business with Global One, the single largest customer in their world. Just like any marketplace, there are activities, processes, terminology and more, that are unfamiliar. The problem is, we don’t give ourselves grace to become acclimated to the differences between where we are, and where we came from, and that leads to challenges. This is not exclusive to the vendors seeking to sell to the Government as a prime or subcontractor. The community of companies that support Federal Contractors, have it just as difficult.

While I was doing research for an upcoming article, I happened upon the User Guides for a recognized provider of federal sector market intelligence. Because several close friends and colleagues are fans of this platform, I decided to take a look to understand their view of things. What I found, very quickly, is completely typical of so many in Federal Contracting, regardless of experience or tenure. Critically important context is lacking. In this instance, because they mine contract action data to republish it using different visualization styles than the Government, it’s especially important for them to understand the data, as that directly impacts how they will handle it before consumers get access to it. If they mishandle the data, it will change the meaning of the information, making it less relevant, or not relevant at all. Let’s assume the user guide I viewed, documentation created to help consumers maximize their use of the platform, was the result of emperical evidence acquired by this company to inform how they would present information to their customers. If my assumption is fifty-percent correct, there is a huge problem.

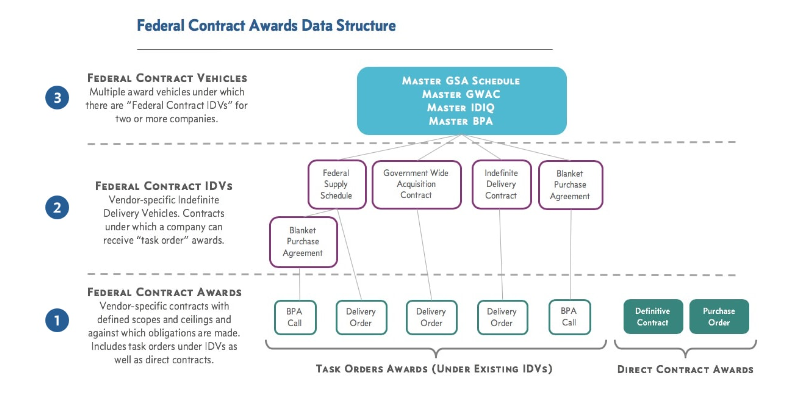

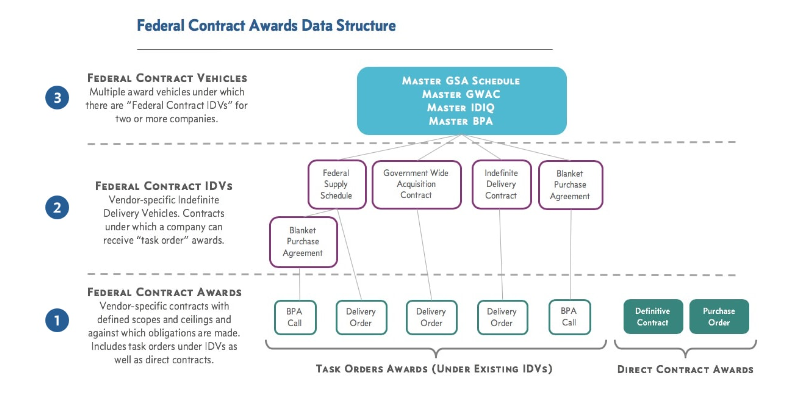

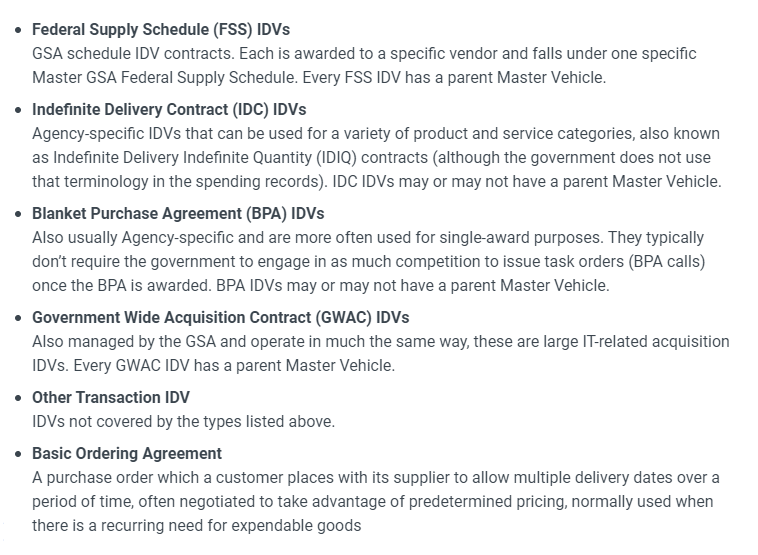

The images below are snapshots from the user guide. Specifically, it’s the section of the guide where they are explaining the hierarchy of data in their system related to awards.The information they used to establish this hierarchy is based on the structure established from the source of transaction data, Federal Procurement Data System (FPDS) ezSearch. They also reference USASpending, another Government site, which pulls its transaction data from FPDS, too. The problem is, this provider clearly does not understand the structure, nor the terminology they are dealing with. For example, in their information, they present ID/IQ (Indefinite Delivery – Indefinite Quantity contract) as being an Indefinite Delivery Vehicle (IDV) Type under which the Government places Indefinite Delivery Contracts or IDCs. The truth is, an ID/IQ is one of three types of IDC, which is one of five types of IDV.

In the image below, they refer to “Master” versions of the GSA Schedule (there are actually VA and GSA Schedules), GWACs, IDIQs and BPAs. This is an unneccessary breakout with errors. By design, the award of an IDV (BOA, BPA, FSS, GWAC or IDC) is the formation of a “master contract. Master IDIQ is actually an IDC, and they omitted Basic Ordering Agreement (BOA).

I do appreciate that they delineated between an FSS/BPA and Open Market BPA on level 2 in the image, but again, a BOA is an IDV and should be represented there as well.

Here’s the other issue. In the text on the left of the image, next to the 3, they refer to all of these vehicles as multiple-award. This is incorrect. Only FSS and GWAC are full time multiple-award vehicles. The truth is, the majority of obligations under IDC (versus IDIQ) and BPA, are single-award.

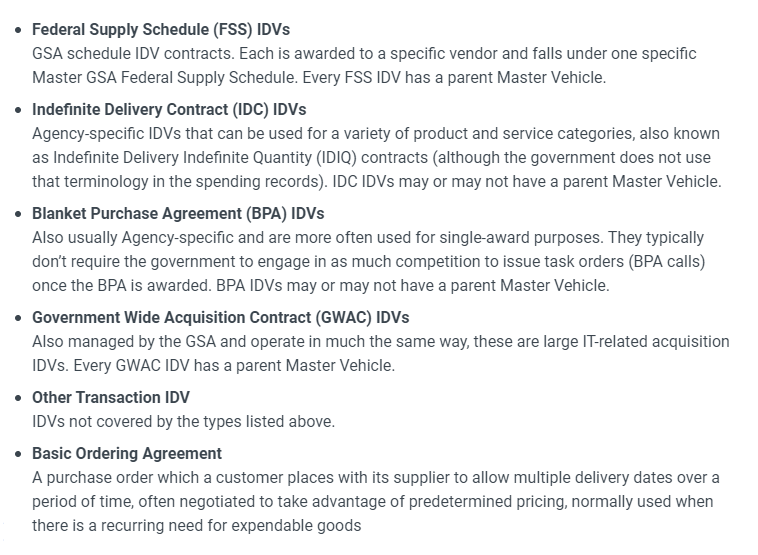

What is most concerning to me is the guidance provided below. The number of incorrect assertions is a red flag as to the integrity of the information they present. It appears they have relabeled data elements, and even omitted some of them from the source sets, changing the meaning and veracity of the information they present. They also apply their own belief system as to how these contracts and contract vehicles are used by the Government.

- By asserting each of the IDVs listed below has a Parent Master Vehicle, shows they don’t recognize that the issuance of an IDV establishes that Parent Master Vehicle.

- Not all IDCs are agency-specific. Think GSA OASIS and GSA HCaTS, both being governmentwide vehicles. Also, the use of the term ID/IQ DOES appear in the spending records, they just don’t see it. And the comment that IDCs may or may not have a parent Master Vehicle is incorrect.

- Orders under a BOA are not Purchase Orders.

- GSA does not manage all GWACs, hence NASA SEWP and NITAAC CIO-SP3 and CIO-CS.

What I’ve presented here is not unique. I can go to any of the market intelligence providers (and I have over the years) and find similar occurrences of them not understanding data elements, or taking liberties with how they represent them on their platforms. Trust, But Verify Your Market Intelligence.

There is a widely-held belief in Government Contracting, that GOOD market and competitive intelligence is the result of securing a subscription to a service like this, and waiting for it to come rolling in. Developing the information and insights you need to find and win contracts and subcontracts is a full contact sport. You must develop baseline familiarity with processes and terminology, and continue developing it for as long as you engage in Federal Contracting. Anything less is not being a good steward of your people, time and money.

Peace, Health, and Success,

Go-To-Guy Timberlake